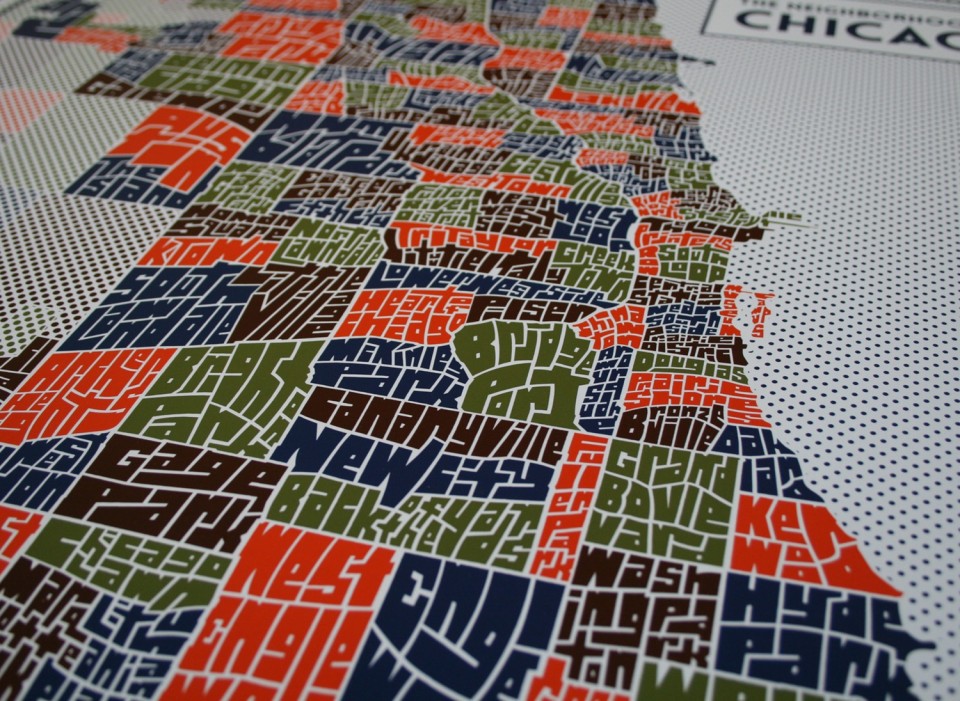

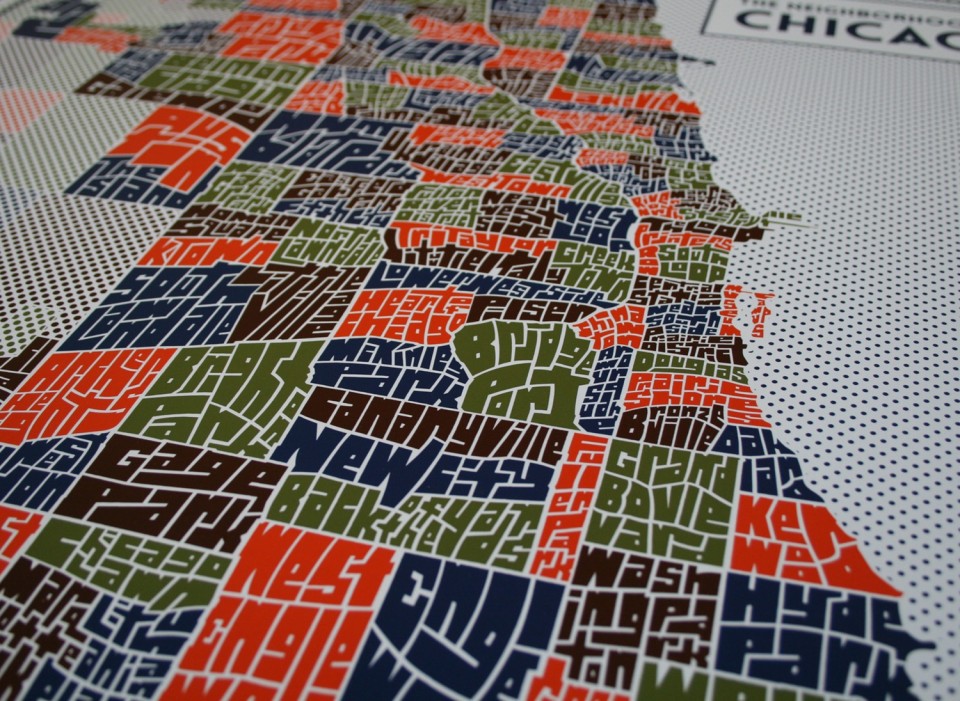

POLL: What’s The Hottest Chicago Neighborhood For New Restaurants?

[interaction id=”578d43eeeaef76d524f801de”]

[interaction id=”578d43eeeaef76d524f801de”]

When a large, public companies or middle market business is considering an exit, they often use a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) to determine a sale price for their business. But what about smaller, independent or multi-unit restaurants?

This brings us to SDE (Seller’s Discretionary Earnings), which can be defined as: (EBITDA + “Owner’s Compensation”). The chart below illustrates how “Owner’s Compensation” is further broken down:

To arrive at SDE, the seller’s financial statements are adjusted to reflect overblown owner salaries, owners perks to include automobile leases, travel and entertainment, life insurance plans and housing allowances, to name a few. If properly documented, these personal and/or discretionary expenditures may be added back to SDE. The SDE adjustments should present the seller’s regular income statement and then shows each adjustment (with an explanation) to arrive at the adjusted SDE.

Other types of SDA adjustments include:

-Above/Below-market rent. If the business is overpaying or underpaying facility rent, the amount needs to be adjusted up or down to reflect the rent a prospective buyer of the business would expect to pay.

-Above/Below-market salaries. Some businesses employ multiple family members who may receive above-market compensation.

-Non-recurring expenses (i.e. litigation expenses due to a lawsuit).

-Non-recurring income (i.e. sale of a fixed asset at a large gain).

Independent Restaurant Valuations are based on multiples of SDA

When it comes to valuing a small business (under $5,000,000 in value), SDE is the most commonly applied metric. The multiples are driven by a range of factors including, financing formulas, the buyer’s target return on investment and the buyer’s need to receive reasonable compensation for the time and effort required to run the newly acquired business. Other factors may include the type of restaurant, i.e., independent, multi-unit, franchise, length of lease remaining, real estate included, opportunity for growth and brand identity that affect the selection of an appropriate multiple.

But one of the primary factors is the level of SDE itself. For financial reasons, buyers are willing to pay a higher multiple for higher SDE. But how does one value a restaurant if there is little or no SDE?

Valuing the Fee/Leasehold Interest

Oftentimes, the restaurant being sold generates little or no SDE. In some cases, the SDE can even become negative. In this instance, an analysis of the business assets together with the underlying fee or leasehold interest in the real estate is required in valuing the restaurant.

If a business leases a building, the rental rate and amount of time remaining on the lease is an important factor. For example, if the annual lease payments are $50,000 below market, a present value analysis using an appropriate range of discount rates should be used to determine the value of the leasehold interest.

In addition, assuming the furniture, fixtures and equipment (FF&E) and certain leasehold improvements are in good-to-excellent condition, the depreciated value of these components should be added to the present value of the leasehold interest.

Determining a market value becomes much more difficult if there is no real estate being conveyed and the leasehold value is minimal. Unfortunately, in this case, unless the landlord is willing to renegotiate and extend the lease, there is probably no value beyond the salvage value of the FF&E.

Reconciling the value conclusions and determining an appropriate multiple to apply to the SDE is generally more of an art than a science. However, an experienced advisor with a deep understanding of local market dynamics, is invaluable when establishing a realistic value for the independent single or multi-unit restaurant.

About SVN Restaurant Resource Group

The SVN Restaurant Resource Group provides first-in-class services to clients in the food service and hospitality industry. Landlords, restaurants, nightclubs, bakeries, caterers, hotels, food processors and manufacturers rely on the experience, local market knowledge, industry relationships and technology advantages possessed by this highly-specialized team of commercial real estate professionals. SVN has over 200 offices throughout the US, Mexico and Canada.

Decided it’s time to sell your restaurant and move on? Just like selling a home, it’s important literally to get your house in order. Here are three ways to get started.

1. Keep accurate books and records, and prepare an accurate valuation analysis.

With today’s bookkeeping technologies such as Quickbooks, keeping good books and records has never been easier for restaurant owners. Spend the money for a good bookkeeper to help keep the financials in order.

Having good books and records spells the difference between selling your restaurant fast and for top dollar and having it sit on the market for months and never selling at all.

But having accurate books and records is only part of the process. A skilled restaurant broker with a deep understanding of financial statement analysis is just as important as the books and records. A broker will dig into the financials and recast them to determine the owner’s discretionary income and then apply the appropriate multiple to the owner’s discretionary income.

2. Get your restaurant organized and staged.

In the real estate business, it is commonplace to stage a home to obtain top dollar as well as sell the home fast. These same principle applies to a business.

Start by having your property professionally cleaned—then maintain it. Be sure to turn the kitchen into a clean, organized, well-oiled facility. Finally, spiff up the dining and bar area by adding flair and class to it. Property stagers can help you do a makeover at a reasonable price. Find one in your area.

By the way, often making over the dining area will not only boost food sales by 10 percent or more, but spending just a few thousand dollars in the dining room can justify as much as a 10 percent jump in prices.

3. Work with a knowledgeable real estate professional.

Don’t underestimate the value a good restaurant broker brings to the table by packaging your restaurant for the market. This means:

• Preparing a thorough valuation analysis

• Reviewing the lease to understand the potential pitfalls in transferring it

• Researching the restaurant’s history to understand its strengths and weaknesses

• Viewing the operation subjectively and looking for ways to improve it

• Comparing your restaurant to other operations in the market

These three simple steps are the difference between having the restaurant quickly sell for top dollar or sitting on the market and never selling at all.

(Chicago, IL) – SVN’s Restaurant Resource Group is on pace for another record breaking year of restaurant transactions. During the first half of 2016, the group consummated a resounding 19 lease and sale assignments. That trend is expected to continue throughout the year.

According to SVN Restaurant Resource Group’s Marcus Sullivan, “We absolutely anticipated this. An unprecedented number of inbound calls came in towards the end of 2015…Today, many of those calls are now executed deals.” According to Sullivan, there are no signs of this trend abating, adding, “And the phones are still ringing.”

Restaurant owners are seeking advisory due in part to pressure on rental rates originating from the 2000’s, when retail supply in prime locations (particularly in the ‘up-and-coming’ corridors such as the West Loop, Bucktown, Pilsen, Andersonville, etc.) was less scarce. Market data shows 2016 retail vacancy continued to contract throughout Chicago, marking three consecutive quarters of positive absorption. City retail vacancies are currently hovering around 7.3%, while suburban submarkets fared equally well, with 616k SF of positive absorption resulting in vacancies of 7.9%.

Legislation passed by the City of Chicago has further generated interest from restaurant operators and developers, looking to better understand opportunities and implications. For instance, many have applauding Mayor Rahm Emanuel’s approving the TOD ordinance, which allows for higher density developments within a quarter-mile of a public transit station and up a half-mile from “pedestrian designated streets.”

“We’re also fielding inquiries from clients who don’t necessarily have an immediate need, but rather just want to talk through some zoning changes or proposed incentives they read about in the paper,” Sullivan says, “many just have a sense that the iron is hot.”

If the first half of 2016 was any indication – all signs point to another landmark year for SVN’s Restaurant Resource Group.

The SVN Restaurant Resource Group provides first-in-class services to clients in the food service and hospitality industry. Landlords, restaurants, nightclubs, bakeries, caterers, hotels, food processors and manufacturers rely on the experience, local market knowledge, industry relationships and technology advantages possessed by this highly-specialized team of commercial real estate professionals. SVN has over 200 offices throughout the US, Mexico and Canada.

This isn’t a dream, West Loop wine lovers. Multilevel wine temple the Lunatic, the Lover & the Poet (736 W. Randolph St., 312-775-0069) comes to Restaurant Row in late August.

Managing partner/sommelier Tom Powers hopes his A Midsummer Night’s Dream-inspired spot will stoke as much passion for vino among Chicagoans as cocktails.

“At most places, either wines or cocktails take the lead,” says Powers. “We have elected to bring cocktails and wine to forefront together.”

The bar features 21 wines on tap, another 30 (15 upstairs, 15 downstairs) by the glass, and 200 bottles. Half are American wines, 40 percent are classic European, and the rest avantgarde. On the “provincial”-style first floor, with a 15-seat bar and 40-seat dining room, wines start at $10 a glass. Upstairs in the more posh lounge, which seats 50 (plus a 40-seat private dining room), wines start at $15 a glass. Got all that?

Steve Carrow (Naha, Brindille) is helming the cocktail program, which focuses on modern interpretations of the classics. And, in what Powers calls a likely first for the nation, each will list alcohol by volume.

The team tapped longtime Spiaggia vet Erik Freeberg (also of Bar Toma) as executive chef, whose small plates and a few entrées will be identical on both floors. Freeberg’s “devilish riffs on classic wine bar cuisine” may include Tunisian-style lamb meatballs braised in tomato and harissa, served with pomegranate molasses, schug, and minty yogurt.

There will be no dessert, only cheese—a mix of classic European and unique American styles, like the wines. “We all love cheese and don’t know much about it other than it’s delightful,” Powers says.

Call us lunatics, but did he just make “no dessert” sound enticing?