Jan 27, 2017

Vice’s Tori Telfer recently reported on a five-course meal at Chicago’s Ruxbin. The catch? Each course of the $125-per-plate dinner was inspired by of Salvador Dali’s infamous 1973 cookbook, Les Diners de Gala.

See the results for yourself:

Beet rose, black sesame dirt, foie gras torchon, brioche, winter lettuce, aerated persimmon, hazelnut, feta, endive. Inspired by “Rose Meditative.”

Egg a la coque sabayon, squid ink noodles, sea urchin, walnut miso, radish, and venison tataki. Inspired by “The Accommodations of Desire.”

Pan-seared red snapper and frog leg, taro root, coconut milk curry, oyster, pomegranate, and tiger sauce. Inspired by “Dream caused by the Flight of a Bee around a Pomegranate a Second before Awakening.”

Sunflower butter truffle cake, concord grape, celery, fennel, honey, and crickets. Inspired by “The Persistence of Memory.”

(H/T VICE)

Jan 20, 2017

Chicago, IL – After another banner year including four new hires and consummating some of the highest-profile restaurant deals in SVN history, the SVN Restaurant Resource Group expects activity will only pick up heading into the year.

One of the year’s most notable tenant rep transactions included an 8,300 SF lease negotiation on behalf of Terra & Vine, the latest concept from celebrity sommelier, Alpana Singh. Founding Restaurant Resource Group team member Jim Martin represented the tenant. The Italian/Mediterranean restaurant and event venue, which officially opened its doors 1701 Maple St in late September, represents one of the largest floorplates of any restaurant in the Evanston submarket.

Martin also advised sale and lease transactions for two new, yet currently undisclosed, restaurant concepts in Winnetka and Hubbard Woods.

On the product side, in one of Chicago’s largest downtown restaurant deals of 2017, SVN represented Chicago-based landlord The Hearn Company in a 10,000 SF space at 70 W Madison St. The space, formerly occupied by a Rosebud Italian restaurant, will now be home to a new concept from the owners of One North Kitchen & Bar.

Business sales were also up in 2016, as restaurant operators looked to reposition themselves amid widely-publicized changes in market trends, including consumer preferences moving towards fast-casual dining in lieu of traditional sit-down or fine-dining concepts. Disposition assignments included the sale of Analogue, Son of a Butcher, Circa57, The Arrogant Frog and Letizia’s Fiore.

SVN Managing Director, Michael Thanasouras remarks, “This is certainly a fast growing group within our Chicago office.” Thanasouras adds, “The folks in our firm who specialize in every other property type are able to leverage the Restaurant Resource Group’s expertise, and vise-versa. We see this as a trend not only locally, but regionally as well as nationally.”

“There’s absolutely no telling just how much activity we’ll see next year.” SVN Restaurant Resource Group’s Tim Rasmussen says. “It will be fascinating to see the landscape 12 months from now. I can’t recall a time, since perhaps the advent of the internet, where we anticipate so many changes in the restaurant industry. That said, there will be plenty of operators able to leverage to their advantage. We’re looking very forward to helping navigate uncharted waters.”

The SVN Restaurant Resource Group provides first-in-class services to clients in the food service and hospitality industry. Landlords, restaurant and nightclub operators, bakeries, caterers, hotels, food processors and manufacturers rely on the experience, local market knowledge, industry relationships, and technology advantages possessed by this highly-specialized team of commercial real estate professionals. SVN has over 200 offices throughout the US, Mexico, Russia and Canada.

Jan 19, 2017

Lisa Jennings | Restaurant-Hospitality.com

For months, industry watchers have been warning about a restaurant bubble about to burst.

It’s a recurring theme that arises whenever a restaurant closes or a chain files bankruptcy. Bubble believers say there are just too many restaurants and not enough people eating out.

“The market is saturated,” said Bonnie Riggs, foodservice industry analyst for research firm The NPD Group, which does twice yearly restaurant counts. “We have more seats than bodies to fill them.”

But for the independent restaurant segment in particular, the bubble has popped, Riggs said. The inevitable correction is clearly taking place, with restaurant counts in serious decline.

In the fall of 2016, for example, there were 620,807 restaurants across the country, down 1.6 percent compared with a year ago. That’s the largest decrease since 1998, when the count began, according to NPD.

That decline amounts to about 9,998 restaurant closures year over year, and most of them were independent restaurants, Riggs said.

The overall count included 221,810 full-service independent restaurants in fall 2016, marking a decline of 3.7 percent year over year for that segment specifically. That translates to a loss of 9,784 independent restaurants.

Meanwhile, the number of chain restaurants grew somewhat, by a count of 2,281 units, or an increase of 0.8 percent. Limited-service restaurants saw the most growth, increasing in number by 7.1 percent, or a net of about 1,560 units, Riggs said.

There have been signs of a weakening climate for full-service restaurants across the board for a year or more.

Higher labor costs have changed the economic equation for many concepts. There are not enough cooks to staff kitchens. Rents in many markets are increasing faster than restaurants, with their very thin margins, can accommodate.

Meanwhile, customers are unwilling to accept higher pricing. Grocery inflation is low and the gap in cost between dining out and eating at home has widened.

“People just think the price-value relationship is out of whack, and they think dining out is a bad value,” Riggs said. “It’s cheaper to eat at home.”

In part as a result, high-end chefs are shifting into the fast-casual segment, with its leaner operating model. That’s where consumers have gravitated and industry prognosticators are predicting more growth.

Chef Mark Ladner is leaving the acclaimed Del Posto in New York to launch a new fast-casual Italian concept called Pasta Flyer in February, for example, though not because of any perceived bubble, according to a spokesperson. He has a mission to make quality Italian food more accessible, he said.

Others have moved toward ultra-high-end omakase or tasting menus, where costs can be controlled and diners may be willing to pay a bit more for an extraordinary experience. But even those examples show signs of trouble.

“Top Chef” contestant Kwame Onwuachi, for example, whose resume includes stints cooking at both Per Se and Eleven Madison Park in New York, opened The Shaw Bijou in Washington, D.C., late last year. Initially, the restaurant featured a $185 per person 17-course tasting menu. A few weeks later, however, Onwuachi lowered the price to $95 per head for seven courses.

Then, only about three months after opening, the restaurant abruptly closed in mid-January. Partners in the concept reportedly blamed high labor and ingredient costs.

Onwuachi, who spoke with Restaurant Hospitality days before announcing the closure, said he wasn’t thinking about any bubble or trends in designing The Shaw Bijou.

“I was thinking more about what do I want to accomplish and achieve,” he said. “It’s always an interesting balance. Being a chef, you’ve got a passion and an art, and you have to balance that with business.”

Thrillist recently made the case for a restaurant bubble about to pop. Writer Kevin Alexander declared America’s Golden Age of Restaurants as coming to an end.

The report pointed to the closure of AQ in San Francisco as almost a poster child for the “perfect restaurant industry storm” on the horizon.

AQ, a 2012 James Beard finalist for best new restaurant in America, served its final dinner on Jan. 14, after five years in business.

But AQ executive chef Mark Liberman disagreed that a restaurant bubble is to blame for the concept’s demise.

“I think AQ has run its course, to be honest,” Liberman said. “It’s two slow years catching up with us.”

The restaurant is located in a “challenging” neighborhood, Liberman said, and although it was hoped that AQ’s early success would bring more critical restaurant mass to the area, that didn’t happen.

In San Francisco, so rich in restaurant options, guests tend to flock to the newest restaurants opening, he said. AQ was a hit early on, but then diners moved on to the next new thing.

“That’s a big trend, with Instagram being so popular and the media pushing what’s new and hot,” Liberman said. “Sometimes it takes a little while for restaurants to find their voice.”

Liberman doesn’t see a bubble so much as a need for restaurant operators to adapt.

In San Francisco, perhaps more than any other city, labor costs have skyrocketed. AQ struggled to deal with rising minimum wage requirements and health care mandates.

“You can only run so long at 40-percent labor [costs] before your growth is impacted,” Liberman said.

Still, Liberman said he plans to jump right back in, after taking a break to travel and dream up his next concept.

He wants to launch his own restaurant group, and he envisions a new format, one with a smaller kitchen staff, while still creating an accessible, full-service experience.

What that might be, he hasn’t quite decided.

“It’s not an easy question to answer,” Liberman said. But it’s probably a question everyone is asking: “How can I run with a smaller team?”

Jan 13, 2017

Jonathan Maze | Jan 12, 2017 | nrn.com

It’s safe to say that 2016 was a challenging year for the restaurant industry. Take it from the restaurant executives who presented to investors at the ICR Conference in Orlando, Fla., this week:

“2016 was challenging,” Papa Murphy’s CFO Mark Hutchens said.

“2016 was the most challenging in our 23-year history,” Chipotle Mexican Grill Inc. founder and CEO Steve Ells said.

“There’s no question it’s been a choppy environment, a challenging environment with customers,” Habit Restaurants Inc. CEO Russ Bendel said.

To be sure, such sentiment was expected. Same-store sales were weak all year, either because there were too many restaurants, too many cheap grocery deals or too many divisive elections.

The tone of executives seems to suggest that the year did not end strong, despite suggestions from companies like Popeyes Louisiana Kitchen Inc. and Del Frisco’s Restaurant Group Inc. that same-store sales improved after the election.

Stifel analyst Paul Westra said in a note Wednesday after the conference that same-store sales fell 2 percent in December, according to his firm’s survey. He called the tone of the conference “subdued.”

Canaccord Genuity analyst Lynne Collier, however, thought that the tone of the conference was “better than we expected,” given the sharp downturn.

Despite such concerns, restaurants are making major investments in technology to win over customers.

Companies continue to make investments in online and mobile ordering, and more are working to use technology to talk directly with consumers.

But by far the biggest move is toward delivery. Most chains talked about making moves into delivery — from vows to test delivery this year (Papa Murphy’s Inc.) to plans to operate delivery itself, rather than through third parties (Panera Bread Inc.).

Some are seeing surprising results: “There’s a lot of folks who like their food delivered after 11 at night,” Jack in the Box Inc. CEO Lenny Comma said during his company’s presentation.

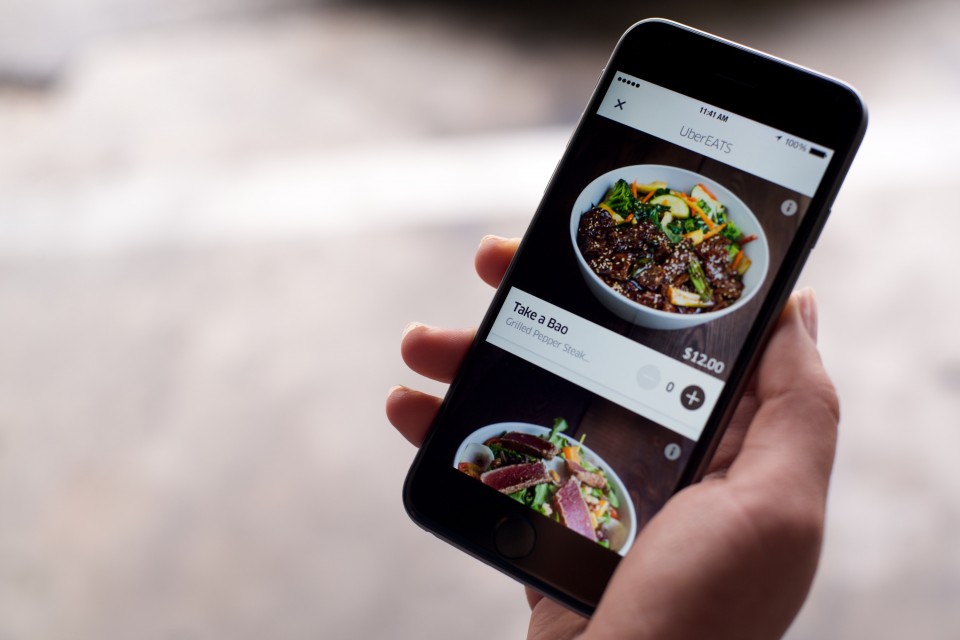

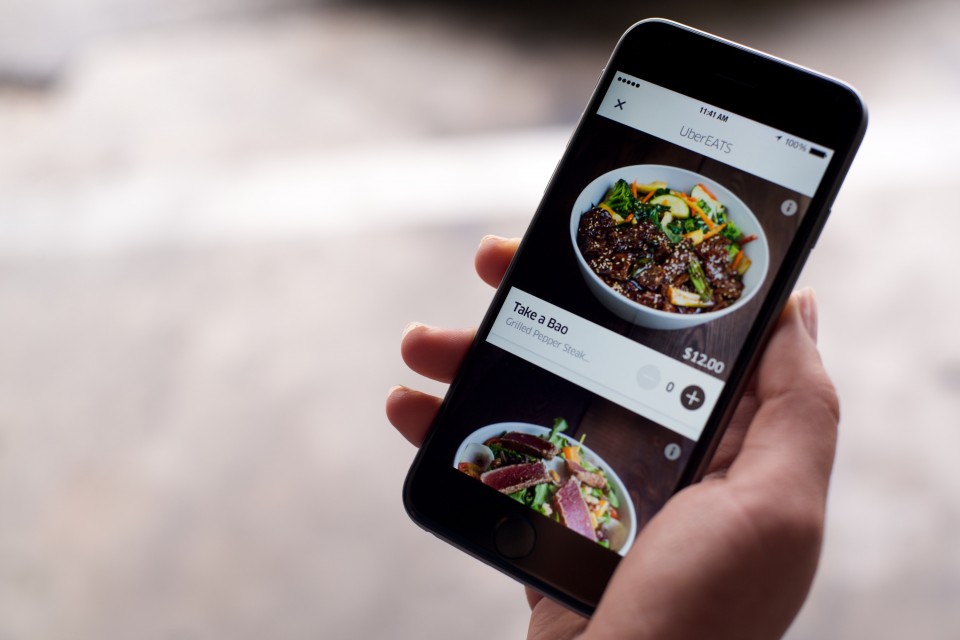

On the other end of the spectrum was Kona Grill, which is also testing delivery with Amazon, UberEats and Postmates. CEO Berke Bakay said the polished-casual chain is seeing “strong results in certain markets,” despite the services high charges.

“I don’t think it cannibalizes existing sales,” Bakay said.

Whether delivery works to generate sales remains to be seen, although there are indications that companies doing delivery aggressively can generate quick sales, especially in markets where consumers are more accustomed to the service.

Technology, although costly, could make restaurants more efficient, even if it remains to be seen whether it actually improves sales.

But there’s nothing like a year of weak sales to spur action on the part of restaurant industry executives — and this week’s ICR Conference proved that.

Jonathan Maze, Nation’s Restaurant News senior financial editor, does not directly own stock or interest in a restaurant company.

Jan 6, 2017

Jonathan Maze | Jan 03, 2017 | nrn.com

A restaurant industry that struggled with weak sales and traffic in 2016 shouldn’t expect much improvement in 2017, according to The NPD Group.

Chicago-based NPD expects restaurant industry traffic to remain stalled in 2017, the market research firm said Tuesday.

Traffic will also continue its long-term shift away from dine-in brands to quick-service restaurants. NPD expects traffic at quick-service restaurants to grow 1 percent this year, while traffic at dine-in locations will fall 2 percent. Currently, the majority of restaurant visits go to limited-service concepts.

“It’s just a battle for share,” Bonnie Riggs, NPD restaurant industry analyst, told NRN. “More restaurants than visitors. And we need to keep in mind that competition is no longer just restaurant competitors. It has become a very fragmented market, and consumers have many options available to them to obtain a prepared meal.”

Industry growth, coupled with growth in prepared food offerings at convenience stores and grocers, has increased options available to consumers. But Americans are not increasing their dining at a corresponding rate. That’s putting pressure on restaurants to fight for their share of the pie.

NPD says that to succeed in 2017, restaurants will have to step up their game, get more innovative and use technology more strategically…Continue Reading