Oct 17, 2017

Lisa Jennings | Restaurant Hospitality | October 10, 2017

The already heated competition for butts in seats in the independent restaurant industry is about to get hotter. But the biggest threat to market share comes not from the restaurant down the street, but from outside the industry.

Restaurant operators may soon see themselves losing guests to the local grocery store offering cooked-to-order meals and table-service, along with a full bar.

At the same time, the young-but-full-of-potential meal-kit industry is also out to steal diners from restaurants, offering quality and unique ready-to-cook-dishes — often at a lower price — directly to consumers where they live.

And there’s potential cross over between the two. Grocery stores are also beginning to offer meal kits to appeal to the growing number of consumers who don’t know how to cook, or don’t want to.

This year e-commerce giant Amazon bought the specialty grocery chain Whole Foods Market, a move that has sparked a wave of speculation about how Americans will be enjoying the home delivery of all manner of fresh ingredients and pre-prepped meals in future.

Behind both of these trends is a common theme: Time-starved diners across the country are looking for convenience.

Consumers want to eat well, but the pull of the couch at home is strong. The one-stop shopping of the “grocerant,” and the home-delivered ready-to-cook meal kit give diners two more reasons to skip the neighborhood bistro.

In the spirit of knowing one’s enemy, here’s a look at the growing threat from grocery stores and meal kits.

Grocery stores get into the restaurant business

For years, restaurants have had to compete with grocery stores, with their in-store delis, rotisserie chickens and salad bars.

Last year, however, eating meals outside the home surpassed those eaten at home, and the grocery industry felt the jolt of a shift in consumer behavior.

In May, grocery spending grew just 2.6 percent year-over-year, compared with a 4.8 percent increase at restaurants, according to credit card company Visa’s Retail Spending Monitor.

Seeing that shift, grocery stores are looking for ways to increase foot traffic and win that spending back.

CONTINUE READING

Jan 13, 2017

Jonathan Maze | Jan 12, 2017 | nrn.com

It’s safe to say that 2016 was a challenging year for the restaurant industry. Take it from the restaurant executives who presented to investors at the ICR Conference in Orlando, Fla., this week:

“2016 was challenging,” Papa Murphy’s CFO Mark Hutchens said.

“2016 was the most challenging in our 23-year history,” Chipotle Mexican Grill Inc. founder and CEO Steve Ells said.

“There’s no question it’s been a choppy environment, a challenging environment with customers,” Habit Restaurants Inc. CEO Russ Bendel said.

To be sure, such sentiment was expected. Same-store sales were weak all year, either because there were too many restaurants, too many cheap grocery deals or too many divisive elections.

The tone of executives seems to suggest that the year did not end strong, despite suggestions from companies like Popeyes Louisiana Kitchen Inc. and Del Frisco’s Restaurant Group Inc. that same-store sales improved after the election.

Stifel analyst Paul Westra said in a note Wednesday after the conference that same-store sales fell 2 percent in December, according to his firm’s survey. He called the tone of the conference “subdued.”

Canaccord Genuity analyst Lynne Collier, however, thought that the tone of the conference was “better than we expected,” given the sharp downturn.

Despite such concerns, restaurants are making major investments in technology to win over customers.

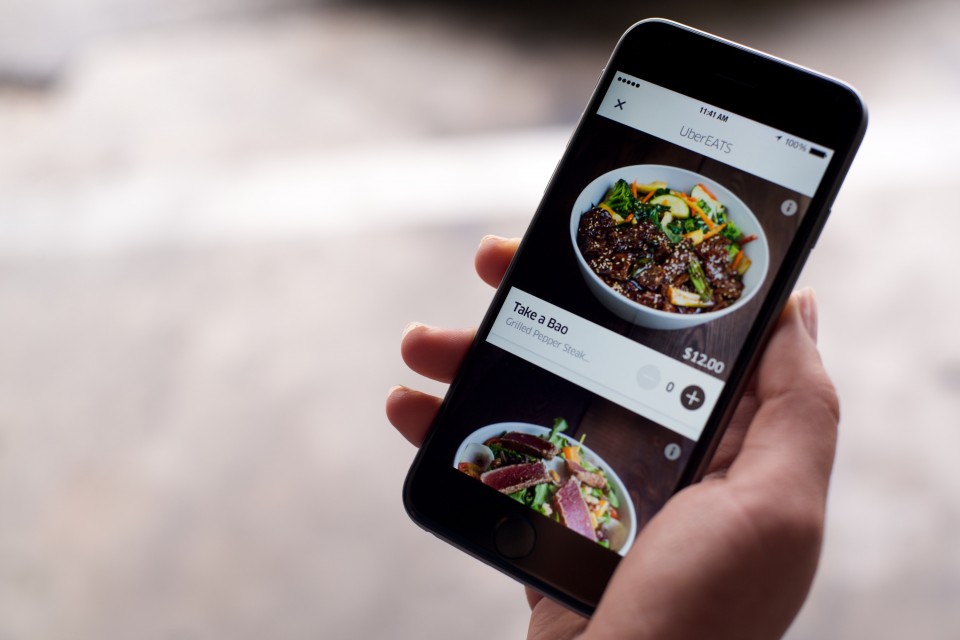

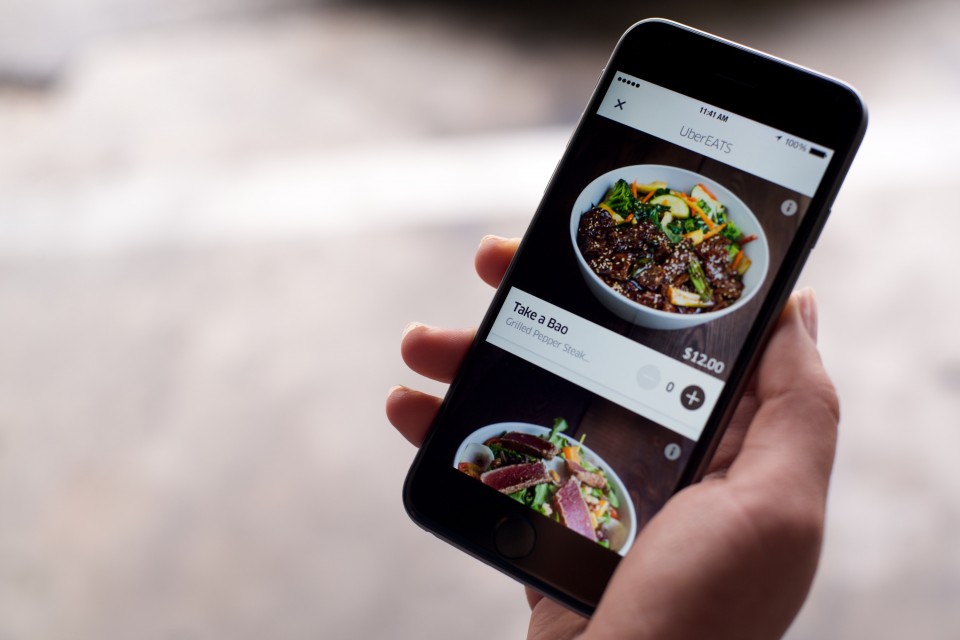

Companies continue to make investments in online and mobile ordering, and more are working to use technology to talk directly with consumers.

But by far the biggest move is toward delivery. Most chains talked about making moves into delivery — from vows to test delivery this year (Papa Murphy’s Inc.) to plans to operate delivery itself, rather than through third parties (Panera Bread Inc.).

Some are seeing surprising results: “There’s a lot of folks who like their food delivered after 11 at night,” Jack in the Box Inc. CEO Lenny Comma said during his company’s presentation.

On the other end of the spectrum was Kona Grill, which is also testing delivery with Amazon, UberEats and Postmates. CEO Berke Bakay said the polished-casual chain is seeing “strong results in certain markets,” despite the services high charges.

“I don’t think it cannibalizes existing sales,” Bakay said.

Whether delivery works to generate sales remains to be seen, although there are indications that companies doing delivery aggressively can generate quick sales, especially in markets where consumers are more accustomed to the service.

Technology, although costly, could make restaurants more efficient, even if it remains to be seen whether it actually improves sales.

But there’s nothing like a year of weak sales to spur action on the part of restaurant industry executives — and this week’s ICR Conference proved that.

Jonathan Maze, Nation’s Restaurant News senior financial editor, does not directly own stock or interest in a restaurant company.